ESCHEWING RE-GLOBALISATION

Samantha Amerasinghe elucidates how re-globalisation can transform trading

Reproduced from the April 2023 edition of LMD.

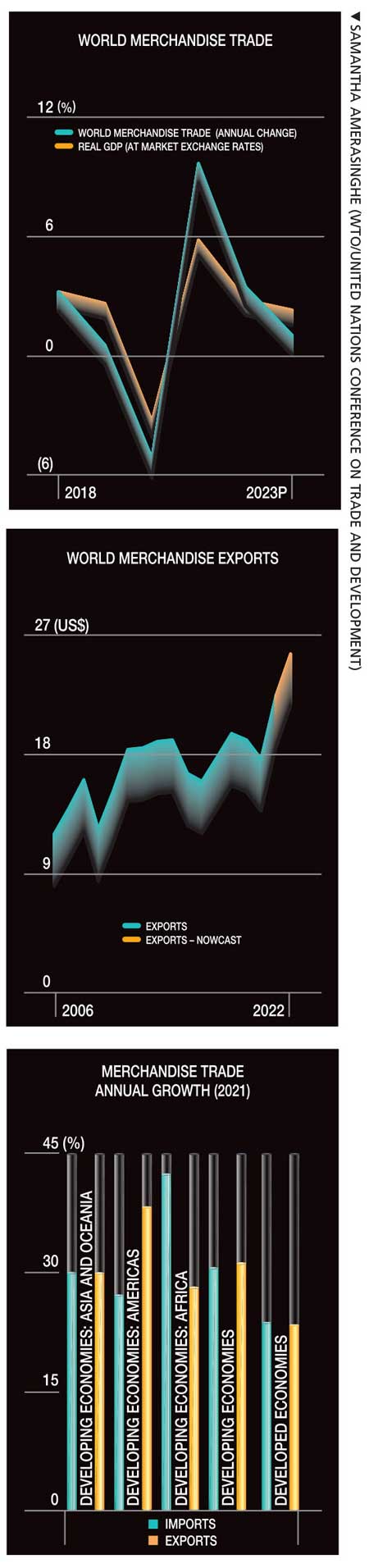

Global trade continues to face multiple challenges as inflation and high interest rates, debt distress and geopolitical frictions weigh on many economies. The negative factors continue to outweigh positive trends. An escalation of Russia’s war in Ukraine, and deepening tensions between the US and China, pose significant downside risks to the world economy and international trade.

The warning lights are blinking. Softening trade performances across Asia have already signalled an end to the export boom. With major economies facing recession, re-globalisation may be the answer to improving the trade outlook as the year progresses.

Global trade is expected to slow sharply this year in line with softening economic growth. Although China will continue to drive demand for some commodities, it will be lower than in previous years and Chinese imports of many consumer goods won’t see a rapid rebound from 2022.

“With major economies facing recession, re-globalisation may be the answer to improving the trade outlook as the year progresses”

In aggregate, Standard & Poor’s Global Market Intelligence forecasts that trade activity worldwide will fall by 1.9 percent (year on year) in real terms in the first quarter of 2023 and 1.4 percent in the second before recovering later in the year to grow by 0.6 percent overall.

International trade volumes are set to decline further as import demand softens, bearing the brunt of persistently high energy costs, and the ongoing rise in prices of intermediate inputs and consumer goods.

Debt sustainability is another concern, given the record levels of global debt and tightening financial conditions, which are expected to further heighten pressure on highly indebted governments. This will amplify vulnerabilities and affect international trade flows.

These negative factors far outweigh the improvements we have seen in logistics and the momentum of international trade from related agreements – such as the Regional Comprehensive Economic Partnership (RCEP) and African Continental Free Trade Area (AfCFTA) – to reach fruition.

Freight and cargo rates – though still higher than pre-pandemic averages – are trending downwards and port congestion is easing.

Many other factors are also likely to affect international trade patterns this year. With risks remaining high for global supply chains, mitigation strategies such as supplier diversification, ‘reshoring’ and ‘nearshoring’ will persist.

De-globalisation or a comprehensive decoupling from China is not a desirable way forward for the Group of Seven (G7) nations or like-minded partners.

On the other hand, re-globalisation – which emphasises greater regional links and the formation of economic blocs for sensitive and strategically important sectors – best exemplifies the current pattern of economic integration and state of play.

Given that extreme weather events are the greatest threat to production networks across the globe, greater regional integration to support diversification efforts and supply chain resilience will be crucial but with added impetus to act on transitioning to a greener global economy.

As 2023 progresses, the strategies and geographies that are winners from sourcing diversification will become increasingly evident, whether this is simple reshoring to cut costs, ‘friend shoring’ to reduce political risks or ‘onshoring’ to mitigate logistics risks.

Furthermore, transatlantic trade links have come under pressure over tensions tied to green energy and industrial policy, as well as the US’ increasingly hawkish stance on China.

Unfair trade practices and protectionism have come to a head, not only with China but also the United States, the EU and other like-minded partners, as they champion their climate ambitions, technological leadership and industrial policy objectives.

EU-US trade relations have soured over the Inflation Reduction Act stateside whereby subsidies and tax cuts to promote electric vehicles (EVs) and other green products made in North America have raised concerns over the European Union’s industrial competitiveness.

China’s growing presence in the new EV market may also exacerbate existing global tensions around industrial policy and unfair subsidies, with its strong state support and increasing dominance, which are posing competitive risks to traditional car exporters such as South Korea, Japan and Germany.

Policies introduced in 2022 – including subsidies for semiconductors, EVs and carbon border taxes – will only begin to bear fruit this year.

For example, the EU’s Carbon Border Adjustment Mechanism (CBAM) could prove to be transformational for supply chain structures over the next decade. By taxing imports based on their carbon content and domestic regulation over European Union norms, CBAM may require businesses to review their sourcing to maintain a competitive advantage.

Notably, China accounted for 15 percent of EU imports of products affected by the initial CBAM round in 2021, which included 17 percent of iron and steel, and 13 percent of fertiliser. Yet, CBAM represented only four percent of Beijing’s exports to the European Union.

On the topic of sourcing electronics, there’s already been a significant shift away from Chinese sourcing for US buyers with such suppliers accounting for only 48 percent of American computer imports last year – down from 61 percent in 2016.

The outlook for global trade remains challenging but there’s hope that through policies implemented in 2022 for greater diversification and a more integrated approach to trade, re-globalisation will begin to flourish.