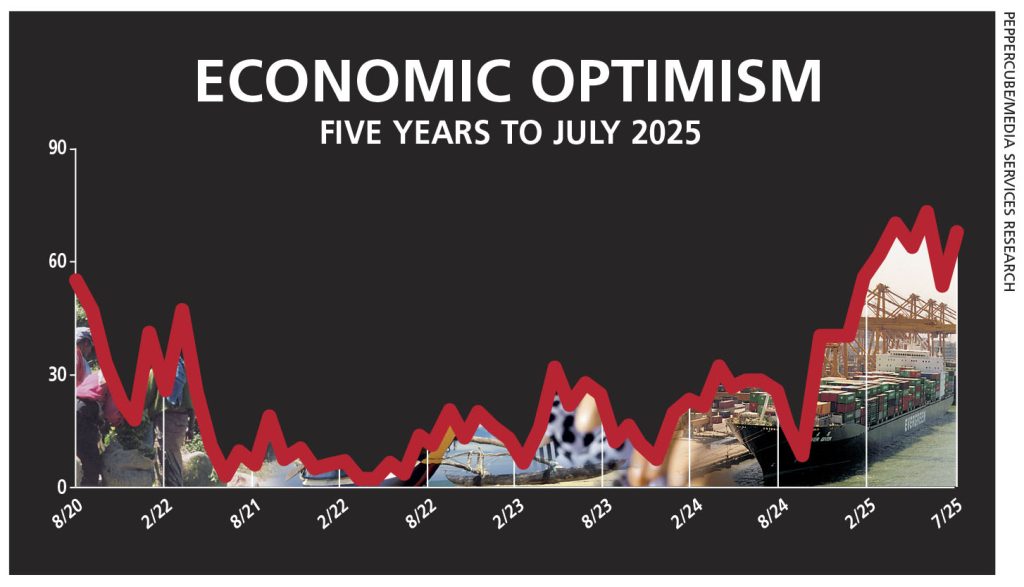

ECONOMIC SENTIMENT SWINGS

Sentiment about the economy shifts direction again by taking a sharp U-turn

Concerns raised by the business community in June appear to have been short-lived with sentiment shifting once again in July.

THE ECONOMY The latest LMD-PEPPERCUBE Business Confidence Index (BCI) survey, conducted in the first week of July, reveals a notable surge in optimism about the economy.

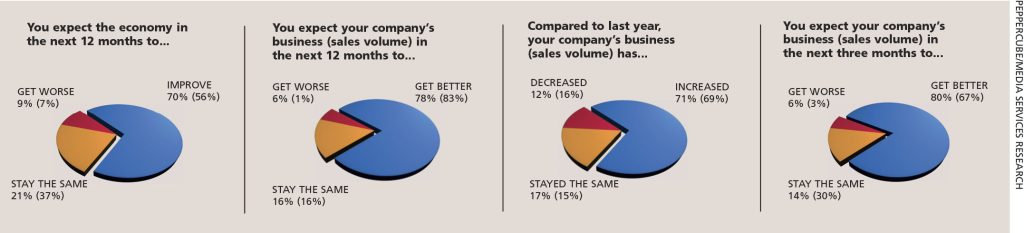

A substantial 70 percent of respondents believe the economy will ‘improve’ over the next 12 months – that’s a healthy 14 percentage point spike from June’s 56 percent.

However, slightly over a fifth (21%) of survey participants expect the economy to ‘stay the same,’ marking a sharp drop of 16 points, while nine percent believe it will ‘get worse’ (up two points from the month prior).

SALES VOLUMES Salespeople’s expectations dipped in July, reversing the brief uptick seen in June, following three consecutive months of decline.

Seventy-eight percent of polled executives expect an improvement in sales volumes over the next 12 months, which marks a five point decrease from June.

And 16 percent of survey participants believe their sales numbers will ‘stay the same,’ which is unchanged from June.

Six respondents expect sales volumes to ‘get worse’ – that’s a five point increase from the previous month.

Meanwhile, the proportion reporting an ‘increase’ in sales volumes compared to the month prior rose slightly to 71 percent (up from 69% in June).

Additionally, 17 percent say their volumes ‘stayed the same,’ reflecting a two point increase from the previous month (15%), while 12 percent report a decline – a four point drop from 16 percent a month ago.

Looking ahead, expectations of higher sales volumes over the next three months have risen sharply with 80 percent of respondents projecting an increase – a notable 13 percentage point surge from 67 percent in June.

Fourteen percent of the sample population believe their sales volumes will ‘stay the same’ (down 16% from the previous month) and only six percent anticipate their numbers to ‘get worse’ over the next three months, which is an increase of three percentage points from the previous month.

INVESTMENT CLIMATE Confidence about the investment climate held steady in July with the percentage of respondents who view the outlook as being favourable remaining unchanged from June at five percent.

However, those viewing the future as ‘good’ climbed 10 percentage points to a third (33%) – and 51 percent continue to believe that the investment outlook is ‘fair,’ reflecting a four percentage point drop from June’s 55 percent.

Meanwhile, the share of respondents rating the investment climate as ‘poor’ or ‘very poor’ dropped sharply to 11 percent (down from 17% in the preceding month).

EMPLOYMENT PROSPECTS Forty-four percent of businesses say they plan to ‘increase’ staff numbers – that’s a 10 point increase compared to June.

In the meantime, 51 percent say they intend to maintain the status quo, which marks a seven point decline.

And only five percent may consider downsizing in the next six months, indicating a sense of stability in the employment outlook.