Nucleus of the Reform Process

“When public finances are self-sustaining, they reduce the need for future tax increases or unpredictable tax policy”

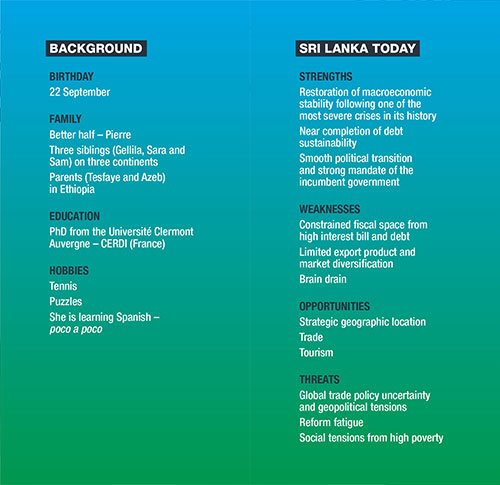

Martha Woldemichael

When Martha Woldemichael arrived in Sri Lanka in October last year – coincidentally a day after the nation’s presidential election – she stepped into a country at a crossroads. Amid a shifting political landscape and economic uncertainties, her appointment as the International Monetary Fund’s Resident Representative signalled a pivotal moment in the nation’s journey towards recovery.

As a seasoned economist and policy advisor with global experience, Woldemichael brings both the technical expertise and strategic perspective required to support Sri Lanka during a critical phase of its engagement with the lender of last resort.

An Ethiopian national armed with a PhD in economics from Université Clermont Auvergne – CERDI in France, Woldemichael’s background blends academia with hands-on policy implementation.

Prior to her posting here in Colombo, Woldemichael served at the headquarters of the International Monetary Fund in Washington D.C., where she worked on numerous IMF supported programmes across countries as diverse as Cabo Verde, Honduras, Niger, Rwanda and Ukraine – each with its unique macroeconomic challenges and reform needs.

These experiences have deepened her understanding of the intricacies of economic recovery in emerging and developing economies.

Her involvement in the design and oversight of lending programmes, especially those supported by the IMF’s General Resource Account (GRA), is particularly relevant to Sri Lanka.

This country’s Extended Fund Facility (EFF) programme, which is a cornerstone of its economic stabilisation efforts, is underpinned by the same lending instrument.

Woldemichael has also contributed to producing analytical work on themes including digitalisation, trade, governance, domestic arrears and the global role of China.

In Sri Lanka, she represents the IMF at a time when the country is navigating fiscal consolidation, debt restructuring and structural reforms – all with a goal of building a more resilient, inclusive and sustainable economy.

Her presence plays a key role in supporting ongoing policy dialogue between Sri Lanka’s government and the International Monetary Fund, ensuring continued programme implementation and stakeholder coordination.

As Sri Lanka works to emerge from one of its most challenging economic chapters, Martha Woldemichael’s expertise and diplomacy stand at the centre of its international financial engagement, offering both assurance and insights as Sri Lanka moves along its reform path.

Compiled by Tamara Rebeira

“Sri Lanka should bring the EFF programme to the finish line and stay the course on reforms to ensure a well-entrenched economic recovery, and unlock sustained and inclusive growth”

Q: The IMF’s staff level agreement on the fourth review of Sri Lanka’s reform programme was reached in April with a disbursement of around US$ 350 million being made recently. In your view, what is the significance of this tranche for the country’s economic recovery?

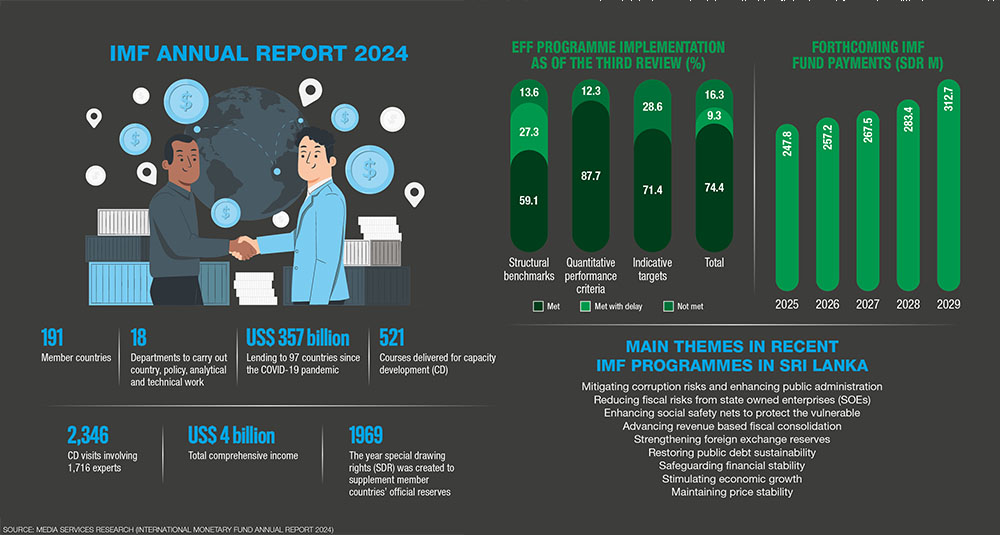

A: The International Monetary Fund’s Executive Board completed the fourth review under the Extend Fund Facility (EFF) arrangement on 1 July. This provided Sri Lanka with immediate access to around US$ 350 million to support its economic policies and reforms.

This is good news as it shows Sri Lankan citizens, investors and development partners that authorities remain committed to macroeconomic stabilisation halfway through the programme. Sri Lanka should bring the EFF programme to the finish line and stay the course on reforms to ensure a well-entrenched economic recovery, and unlock sustained and inclusive growth.

“Bringing inflation down from the very high levels seen at the height of the crisis has been paramount to reducing the negative impact of the crisis on the most vulnerable”

Q: Sri Lanka has made significant strides in debt restructuring – including inking agreements with Japan and international bondholders. What are the remaining challenges in this process, particularly concerning negotiations with other bilateral creditors – and how would this process affect the programme’s trajectory?

A: The country’s debt restructuring is almost complete. The Eurobond exchange was successfully completed in December last year.

And Sri Lanka has signed bilateral agreements with Japan, India and France, and reached agreements in principle with Saudi Arabia and Kuwait. Of the US$ 28 billion of external debt under the restructuring perimeter at the end of 2023, only around 0.5 billion dollars remains, for which restructuring agreements need to be reached.

The next step is to finalise the remaining agreements with official and commercial creditors – a process that authorities expect to complete this year. The finalisation and execution of debt restructuring agreements, along with continued fiscal prudence and reforms, are key to restoring debt sustainability.

Q: There’s public scepticism in some quarters regarding the role of the International Monetary Fund in this country. What would you say to critics who argue that the EFF framework disproportionately affects the vulnerable?

A: Let me start by clarifying that, as the IMF’s Managing Director says: “We are not your grandmother’s IMF.”

IMF programmes have changed in recent years. Protecting the poor and vulnerable is an important component of the authorities’ reform programme supported by the EFF.

The poor and vulnerable have been most affected by the crisis. They have been impacted by high inflation and cost of living, and loss of employment. Yet, they have limited resources to withstand economic hardships. The economic reform programme supports Sri Lanka’s efforts to restore and maintain macroeconomic stability.

This is critical because macroeconomic stability is also about price stability; bringing inflation down from the very high levels seen at the height of the crisis has been paramount to reducing the negative impact of the crisis on the most vulnerable.

The programme also prioritises progressive tax measures to ensure a greater contribution from high income earners. By strengthening public finances under the IMF supported programme, Sri Lanka is also rebuilding the fiscal space it needs to spend on essential services.

Beyond the benefits of macroeconomic stabilisation, we encourage authorities to sustain social protection reforms to shield vulnerable households from the impact of the crisis and policy adjustments.

These reforms aim at strengthening the targeting, coverage and adequacy of social safety nets such as Aswesuma. The IMF programme also includes a floor on social spending to ensure that fiscal consolidation does not come at the expense of those most in need.

Q: What are the main risks to Sri Lanka’s economic recovery in the medium term – and how can they be mitigated?

A: We expect the economy to continue recovering – contingent on sustaining the reform momentum and the strong performance of the economic reform programme supported by the EFF, notwithstanding some programme implementation risks around cost recovery, energy pricing and tax exemptions that are being addressed.

That being said, Sri Lanka is operating in a challenging global environment, marked by elevated uncertainty related to tariffs and geopolitical conflicts, which could negatively affect the economy.

While the occurrence of external global shocks is outside the control of authorities, it’s possible to mitigate their impact by strengthening the resilience of the economy. This can be done by rebuilding fiscal and external buffers to ensure that Sri Lanka has the necessary policy space to respond to shocks.

Q: Good governance and addressing corruption vulnerabilities are central to the IMF’s programme. What progress do you believe has been made in these areas? And what challenges remain in ensuring transparency and accountability in the public sector?

A: Sri Lanka has taken major steps in strengthening governance and advancing its anticorruption agenda.

Important milestones have been achieved through enacting key legislation for safeguarding the independence of the Central Bank of Sri Lanka, improving public financial management and strengthening the legal framework for anticorruption.

In 2023, Sri Lanka became the first country in Asia to undergo an IMF Governance Diagnostics Assessment (GDA). Some recommendations of the GDA – such as publishing public procurement contracts and a list of businesses benefiting from tax exemptions – were included in the Extended Fund Facility programme, given their criticality for achieving the authorities’ objective under the EFF to reduce corruption vulnerabilities.

Going forward, we hope to see continued emphasis on improving governance. Effective implementation of the recently published government action plan on governance reforms is critical in this regard.

Under the EFF, authorities are taking steps to strengthen the asset declaration system, the tax exemptions framework, and the Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) regime.

They are also prioritising anticorruption reforms at the customs and enhancing procurement processes to curb revenue leakages.

As authorities pursue this wide-ranging governance agenda, it would be important to bring civil society along to establish public trust in reforms and secure broad support.

“Sri Lanka has taken major steps in strengthening governance and advancing its anticorruption agenda”

Q: Likewise, is Sri Lanka making any progress in its quest to reduce poverty and youth unemployment – given that the numbers have yet to move in the right direction?

A: Poverty is on a downward trajectory, according to the latest World Bank estimates, having declined from 27.1 percent in 2023 to 24.5 percent last year.

While it is projected to reduce further in the medium term, poverty is expected to remain almost twice as high as it was in 2019.

Similarly, unemployment and emigration remain elevated in Sri Lanka. Sustaining macroeconomic stability – especially price stability, by putting a check on inflation – is a prerequisite for bringing poverty rates down. This is due to inflation eroding real wages and affecting the poor disproportionally.

Accelerating growth and job creation is also crucial for rapid poverty reduction.

This necessitates measures to promote female labour force participation, address the skills mismatch and improve the business climate. As some reforms take time to bear fruit, in the meantime, the most vulnerable should be protected through targeted social safety nets such as the Aswesuma cash transfer scheme.

Q: What role do you hope the private sector will play in Sri Lanka’s economic revival – and what reforms are essential to unlock investments and FDIs?

A: In a context of scarce public resources and constrained fiscal space, the private sector has a key role to play in supporting economic recovery and driving growth. The government should create an enabling environment for such growth to happen.

Sri Lanka can secure investor confidence by sustaining prudent fiscal and monetary policies, and staying the course on reforms – including improving the business climate by tackling corruption vulnerabilities.

Successful completion of debt restructuring will also send a positive signal to domestic and international markets.

Q: With the tax burden being a hot button topic, what is your take on balancing the need for increasing state revenue with creating a business and investor friendly tax regime?

A: Leading up to the economic crisis, Sri Lanka ran persistently large fiscal deficits, which reflected substantially low tax revenue owing to a combination of low tax rates, narrow tax bases and limited collection efficiency.

At only 7.3 percent of GDP in 2021, tax revenue to GDP was one of the lowest in the region.

When the EFF programme was approved, one priority was to implement revenue based fiscal consolidation to rebuild the fiscal space Sri Lanka badly needed to finance essential services and restore debt sustainability. By 2024, tax revenue to GDP had reached 12.4 percent.

Overall, tax reforms under the programme are designed to be progressive as it is important that those who can most afford it make commensurate contributions to financing necessary government expenditures.

Although it may sound counterintuitive, a higher and diversified tax regime can be good for business confidence – when public finances are self-sustaining, they reduce the need for future tax increases or unpredictable tax policy, which lends itself to stability.

Q: Does the IMF view the lifting of the vehicle import ban favourably, despite downside risks such as depleting forex reserves and a run on the currency?

A: The lifting of import restrictions on motor vehicles was a prerequisite under the EFF programme.

It’s a key measure underpinning authorities’ revenue mobilisation efforts this year and is expected to yield 1.2 percent of GDP in revenue – out of 1.5 percent of GDP in tax revenue gains projected this year.

This estimate already factors in the possible impact on international reserves and the exchange rate. Thus far, we see good momentum in automobile imports, and concerns about pressure on international reserves and the exchange rate have not materialised.

“Sri Lanka can secure investor confidence by sustaining prudent fiscal and monetary policies, and staying the course on reforms – including improving the business climate by tackling corruption vulnerabilities”

Q: How do you view Sri Lanka’s progress in bringing inflation under control? And what more must be done to sustain price stability going forward?

A: Sri Lanka has come a long way in restoring price stability, bringing inflation down from record high levels (headline inflation peaked at 70 percent year-on-year in September 2022!) to single digits at present.

This remarkable turnaround was made possible by inter alia, decisive monetary and fiscal policy tightening, and the discontinuation of monetary financing.

Going forward, the Central Bank should remain committed to its price stability mandate and be ready to adjust the monetary policy stance in light of domestic and global developments.

Under the EFF programme, we monitor authorities’ progress towards steering inflation to the five percent target through the Monetary Policy Consultation Clause (MPCC) conditionality. The Treasury should also play its part by implementing prudent fiscal policy and by upholding the Central Bank’s independence.

Q: What steps should Sri Lanka take to be in a position to repay its debts in less than two years – and where do the sensitivities lie?

A: What will be key to putting Sri Lanka on a strong footing to address upcoming debt service commitments is for authorities to persevere in their efforts to rebuild fiscal space and external buffers, and pursue growth enhancing structural reforms.

This requires successfully restoring debt sustainability by completing restructuring and observing fiscal discipline at all times. Steadfast implementation of fiscal reforms is also crucial.

For instance, Sri Lanka should ensure continued progress in improving tax compliance, broadening the tax base, strengthening debt management practices and mitigating fiscal risks from state owned enterprises (SOEs), including through cost recovery energy pricing.

At the same time, corruption vulnerabilities should be tackled to prevent revenue leakages; tax incentives should be granted in limited and well-defined cases, based on a transparent and rules based framework.

Importantly, the poor and vulnerable should be protected to secure the social feasibility of reforms.

“We at the International Monetary Fund value our engagement with Sri Lanka, and are committed to being a steadfast partner to the country and its people”

Q: Looking beyond the current programme, how does the IMF plan to support Sri Lanka in sustaining economic reforms and achieving long-term sustainable growth?

A: In addition to financial support through the EFF programme, the IMF conducts Article IV Consultations in Sri Lanka to review the country’s economic and financial policies, and provide appropriate policy advice.

Such bilateral surveillance or health checks of the economy is essential to identifying risks that may threaten the reform momentum and require remedial policy adjustments.

The IMF also supports Sri Lanka through technical assistance and training to help the country build capacity in key areas, such as public finances and monetary and financial policies.

This should help strengthen state capability and institutions, which are critical for sustaining economic reforms and achieving sustainable growth.

And let me end by saying that we at the International Monetary Fund value our engagement with Sri Lanka, and are committed to being a steadfast partner to the country and its people.