BIZ CONFIDENCE TUMBLES IN JULY

The barometer of business confidence free falls after a temporary stint at the summit

July has been a month of both optimism and mounting uncertainty for Sri Lanka. On a positive note, the IMF approved its fourth review under the country’s 48 month Extended Fund Facility (EFF), unlocking a disbursement of US$ 350 million to support ongoing economic reforms.

However, this encouraging development was tempered by troubling news from the US when President Donald Trump announced a new round of tariff hikes targeting more than a dozen countries including Sri Lanka. The sweeping measures impose a reciprocal 30 percent tariff on all Sri Lankan exports to the United States from 1 August, unless a trade deal to its liking is inked by then.

This blanket tariff applies across the board and is in addition to any existing levies, leading to fresh concerns for the country’s export driven industries – particularly apparel.

As is the case here in Sri Lanka, government spokespersons hailed their efforts to reduce the tariffs from 44 to 30 percent while the opposition benches reacted by hurling brickbats at the negotiators, some of whom also represented the former regime!

What’s more, the government’s decision to impose a new 18 percent VAT on digital services provided by non-resident companies – effective 1 October – has sparked criticism. And consumers have expressed frustration over the growing tax burden, especially when disposable incomes are already under pressure.

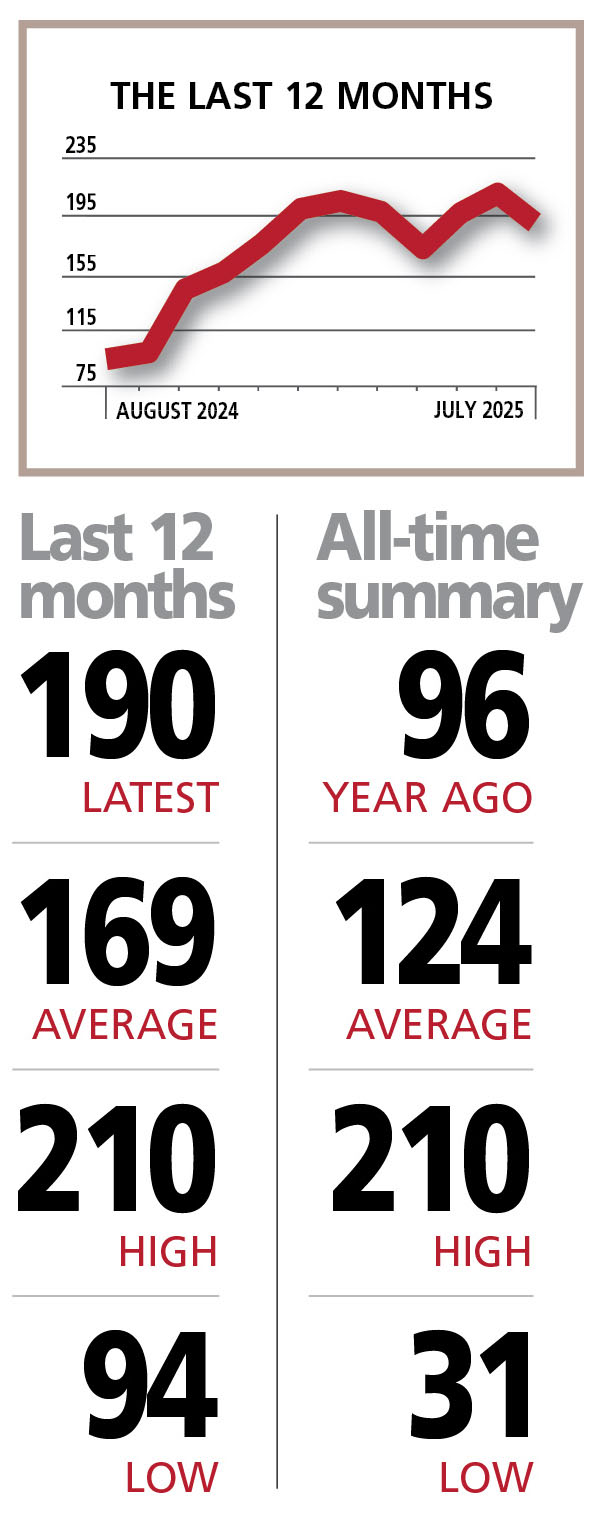

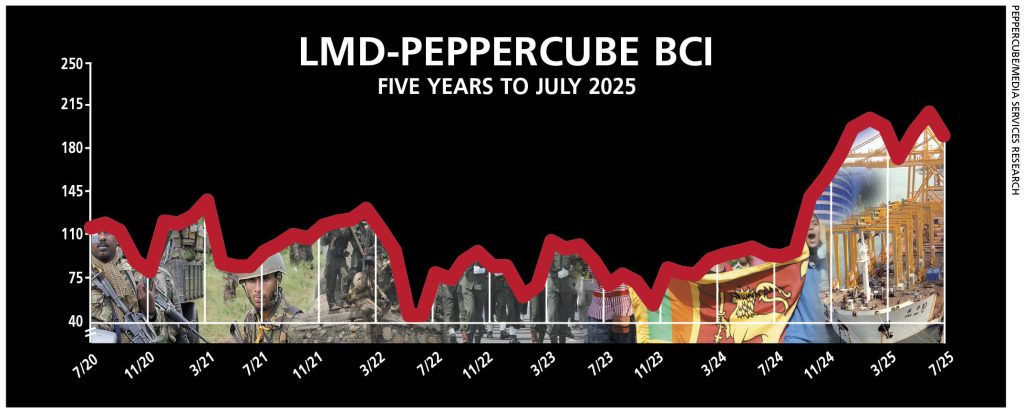

THE INDEX The LMD-PEPPERCUBE Business Confidence Index (BCI) tumbled in July, shedding 20 basis points to register 190 – down from its historic peak of 210 in the previous month.

While still relatively elevated, this free fall signals a shift in sentiment in corporate circles.

That said, the index remains above key benchmarks: it is 66 points higher than its all-time median of 124 and 21 notches above the 12 month average of 169. And in stark contrast, the BCI stood at only 96 in July last year, highlighting the substantial recovery in confidence over the past year.

According to PepperCube Consultants, Sri Lanka’s improving investment climate offers pockets of opportunity. However, critical concerns such as excessive taxation, bureaucratic red tape and the emerging issue of national security are weighing heavily on business sentiment.

PROJECTIONS The BCI’s record high in June may have come as a surprise but its July downturn was not unexpected.

As we predicted, business confidence is showing signs of losing momentum – and we believe this trend will continue in the near term at least.

Globally, the OECD warns that rising trade barriers, tightening financial conditions, eroding confidence and persistent policy uncertainty are expected to dampen growth.

Locally, the picture remains fragile. Ongoing political instability, high profile reshuffles at state institutions and persistently high consumer prices, most recently in essentials such as milk powder, signals the onset of inflationary pressure.

Given these headwinds, we reaffirm our view that the BCI’s record setting climb would be short-lived. Barring a reversal of current misfortunes, the index is unlikely to turnaround anytime soon.

In our opinion therefore, the BCI has reached its summit – and the descent has begun.