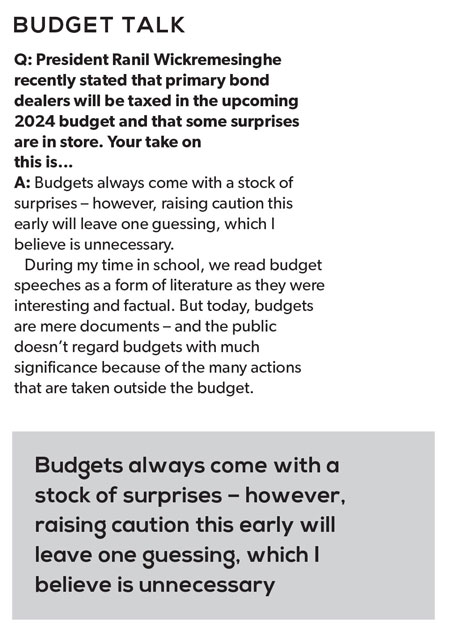

“My intuition is my strength.”

Dr. T. Senthilverl

As I sat down for this exclusive interview with one of the most low-profile yet high net worth businessmen in Sri Lanka, what struck me was the realisation that this is no regular, extravagant entrepreneur.

In fact, describing him as an ‘ordinary gentleman’ could well be fitting.

Dr. Thirugnanasambandar Senthilverl is a renowned investor and businessman – and he exudes humility along with thought-provoking perspectives that challenge conventional beliefs.

Indeed, he might be a stranger to some and familiar to many.

Upon entering his residence, I was moved by the sheer simplicity of his home. The sparsely furnished interior complemented by antique furniture caught me by surprise. Following a warm welcome from his family and a brief wait, the man himself arrived.

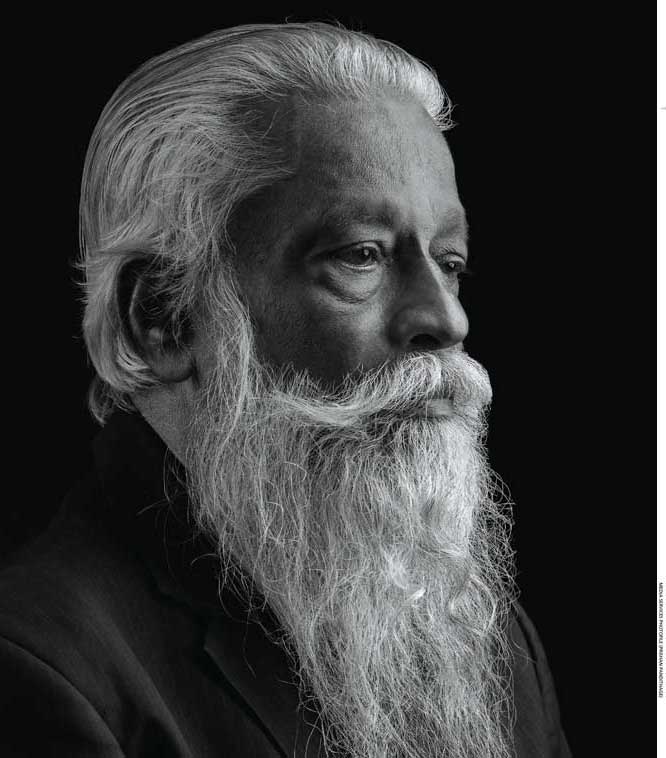

The truth therefore, is an unwavering companion in both his personal and professional life. Even in jest, he claims he’s not lied to his family

In stark contrast to the handful of images that one sees online, I was brought down to earth by a gentleman clad in a sarong and shirt with bare feet, who took his seat opposite me… and dived right into it!

He readily acknowledges that since his entry into the business world, he’s come a long way and is a man of many trades today.

Senthilverl also serves as a director on the boards of numerous high profile organisations in the country and is the largest shareholder in some of them. He proudly and contentedly states that at the age of 77, he’s “a very happy man.”

Describing himself as an avid nature lover who views every facet of life as a stepping stone to the journey of evolution, he strongly believes that being truthful has been – and continues to be – his strength.

The truth therefore, is an unwavering companion in both his personal and professional life. Even in jest, he claims he’s not lied to his family.

His day begins with meditation, a practice that fuels his commitment to being a vegetarian and a conscious consumer. For Senthilverl, religion is akin to science – and he believes that “common threads unite all religions and languages – and differences arise from misunderstandings and personal preferences.”

Religion plays a significant role in his life. He seeks guidance from God, much like how parents would guide a child. And he says that he’s devoid of all materialism – to the extent that he doesn’t consider the house that he resides in as his own.

Senthilverl has undoubtedly scaled great heights. Yet, he remains firmly grounded and attributes his success to his intuition. To this end, he serves as a testament to the values of humility and spirituality, which he holds close to his heart, in navigating the challenges of the modern world of business.

– Compiled by Tamara Rebeira

FAST FORWARD 10 YEARS

Sri Lanka, South Asia and the world will witness unbelievable changes

Q: You’re a low profile but frequent and substantial investor in the local stock market. How do view the prevailing economic climate and its impact on the Colombo Stock Exchange (CSE)?

A: The economic climate is gradually improving from a state of despair. With further improvement, the stock market too will recover simultaneously.

When the economy was hit hard and it was widely felt, there was panic selling in the market while forced selling by lenders took a major toll on the CSE. However, market conditions are more favourable today and many investors who pulled out are thinking about returning to the stock market.

Q: What sectors or industries that are represented on the stock market do you find most promising at this time – and why?

A: Banks appear to be the most promising sector at present and they are performing well. Previously, there was a dark cloud hanging over the future of bank earnings. However, following the announcement of the domestic debt optimisation (DDO) framework, there has been some relief – and it’s expected that banks will perform better.

As the economic recovery gains ground, consumer goods and construction are two sectors that appear to be promising in the long term. Additionally, the renewable energy sector is also a sound bet for higher profits. Many organisations have already made investments in the sector and unlike most others, the required raw materials are cost free.

Banks appear to be the most promising sector at present and they are performing well

Q: Have political or macroeconomic developments – for example, the debt restructuring programme and talks with the IMF – influenced your investment decisions this year?

A: Yes, indeed. There’s a crowd instinct among investors in the market; and when the market experiences an upward trend, everyone rushes to buy. Many benefit in the short term, though they lose out in the end.

But I am different.

Statements are being made that the market is currently dull and I believe this is the best time to buy. With the ongoing IMF discussions and the government having confirmed that there’s no alternative but to adhere to its conditions, it’s a given that proceedings will be successful.

Therefore, I believe the market will improve.

Q: How do you view the role of foreign investments in the CSE? And do you believe there’s scope for forex inflows into the local market despite the economic challenges we face?

A: There’s less scope than desired. Over the years, we’ve missed many opportunities – especially when Hong Kong was taken over by China. At the time, Hong Kong was a financial hub hosting numerous buying houses for the world.

However, Sri Lanka failed to seize the opportunity to become a hub. Today, we have the opportunity to transform Sri Lanka into a hub for shipping, finance and aviation. Ships sailing to India can unload goods in Colombo and we can establish a feeder service to India. These resources must be fully utilised.

Hong Kong, Singapore and Dubai don’t have an abundance of natural resources; yet, they’re thriving. Singapore in particular, is a city-state but is very prosperous. In contrast, Sri Lanka has ample natural resources that remain untapped. This is one of the reasons for missing out on numerous opportunities. We must strive to prosper.

I chose to remain here while the majority of my family reside overseas because Sri Lanka is a blessed country – while it may look greener outside, in reality it isn’t so.

In order to increase forex inflows, Sri Lanka should aim to become a hub that would automatically attract foreign investments. Foreign investors prioritise security, stability and consistency. They also follow Fitch Ratings and Sri Lanka’s current standing is not its best.

Certain foreigners seek larger profit margins with minor risks, which isn’t healthy for the country. Major players on the other hand, will consider Sri Lanka if the right environment prevails.

Hong Kong, Singapore and Dubai don’t have an abundance of natural resources; yet, they’re thriving. Singapore in particular, is a city-state but is very prosperous

In some countries, embassies function as their respective boards of investment. Our Board of Investment (BOI) is designed to demonstrate that Sri Lanka is a one-stop shop for all investment related activities including setting up and registration. In certain nations however, the embassies and high commissions act as one-stop shops, thereby eliminating the need to travel to their countries.

Our embassies and high commissions should work in tandem with the BOI to ensure that all facilitations including registrations are completed prior to investors entering the country. Foreign investors are concerned about the security of their investments, operational aspects and currency stability.

With a stable currency, they’re confident that their investments are secure and they can garner profit margins.

A stable government is also crucial. Most investors entering the country carry a high level of risk and expect high returns, which may not be healthy for us. We should aim to attract all types of investors like we do in the case of local investors.

Q: The BOI Chairman Dinesh Weerakkody says that in order to reform the business and investment climate, it’s essential to have a consistent policy environment that is favourable for investments. How important and crucial are these policy decisions?

A: His statement is accurate – consistent policies are essential to attract investments.

Here as well, consistency and security are important. Foreign investors are required not to make money from currency fluctuations but to benefit from the products they offer, which also helps the country. If only an investor benefits while the country loses, the approach isn’t sustainable.

Therefore, currency stability is crucial.

Regarding bank policies, in the past when the Central Bank of Sri Lanka issued directives, banks were respectful and implemented the necessary measures. But today, there are instances when Central Bank directives are disregarded.

For instance, the interest rate, which stood at seven to nine percent, was increased to 30 percent as the banks had a freehand. However, when the Central Bank issued a directive to lower rates, they reduced it to between 18-22 percent.

Even fixed deposits were offered high interest rates, which have now been lowered – and additionally taxes must be paid. Due to such actions, people are discouraged from investing in banks. Those who moved their investments out of the stock market and placed their money in banks are likely to return to the market.

Q: How do you assess the long-term stability and growth prospects of our economy and its impact on your investment strategy? What sensitivities would you cite in this regard?

A: There’s potential for strong economic recovery and growth but consistent policies must be implemented.

Firstly, the exchange rate must stabilise. In the past, we witnessed sudden steep fluctuations in exchange rates, which deters investors.

This instability leads importers to reduce their minimum quantities while retail traders also stock the bare minimum. As a result of wide fluctuations, consumers adopt a ‘wait and see’ attitude. Moreover, Sri Lanka’s poor ratings also deter foreign investors.

Furthermore, the agriculture sector must be encouraged with a focus on adding as much value as possible. By observing neighbouring countries in the region with flourishing economies despite having limited natural resources, it’s evident that Sri Lanka has tremendous opportunities bestowed on it by nature.

We are also strategically located in the midst of major cargo destinations, presenting an opportunity to establish Sri Lanka as a hub for finance, aviation and shipping. Such a transformation will lead to a substantial boost to the economy, positioning us as an investment and financial hub.

To achieve long-term stability, local production must also improve and we have all the natural resources necessary for this purpose. The government must play an active role in encouraging and supporting the farming community, and give them prominence in these efforts.

There’s potential for strong economic recovery and growth but consistent policies must be implemented

Hong Kong, Singapore and Dubai don’t have an abundance of natural resources; yet, they’re thriving. Singapore in particular, is a city-state but is very prosperous

Q: Prior to this, the president said that the property tax will be revamped, and a wealth and wealth transfer tax – i.e. on inheritances – will be introduced. How do you view these potential additions to the tax regime?

A: Any country depends on tax collections. However, if the heir is inheriting a property from his or her ancestors, you don’t expect him or her to sell the property to pay taxes.

If parents seek to transfer their wealth to their children while they’re alive, do you expect children to sell the property to pay taxes, potentially leaving them or their parents in a precarious situation?

Similarly, if someone donates the only property he or she owns to a temple, should the temple have to bear the transfer taxes? It’s essential to bear in mind that there is no cash transaction involved but merely a transfer of property.

I’m reminded of an old poem Puranaanooru Verse 184 by poet Pisiranthaiyaar during the Sangam period. During this period, there was a Pandya King by the name of Arivudai Nambi who imposed heavy and unbearable taxes.

There were no avenues for the people to voice their grievances. In the end, they sought the intervention of this poet to alleviate them from their predicament.

The poem serves as an eye opener and was quoted by Indian Finance Minister Nirmala Sitharaman in the Indian parliament and received a lengthy round of applause from all parliamentarians – including strongman Prime Minister Narendra Modi.

The poem reads: “If the ripened paddy in a small farm is harvested and cooked, and an elephant is fed, the paddy lasts a long time. But if an elephant enters a large paddy field, more paddy will be trampled and wasted than its one day’s tummy full.”

Q: According to the Governor of the Central Bank of Sri Lanka Dr. Nandalal Weerasinghe, a sizeable and swift downward adjustment in market lending interest rates is expected in the near term. He said so in LMD’s October cover story. Where do you stand on interest rate policy in the context of business and investment prospects?

A: This is welcome news, indeed. Banks often hesitate to reduce lending rates but increase rates instantly.

In the context of business and particularly in investment, the borrowing rate is a key factor. Investors have been facing major challenges over the past few years due to high interest rates.

Furthermore, there have been numerous instances where lenders forced selling, causing a downward trend in the market. With the prospect of lending rates coming down, the stock market is expected to be more lucrative again.

Q: Business confidence continues to languish below desirable levels, according to the LMD-NielsenIQ Business Confidence Index or BCI. Does this affect your decisions to invest in Sri Lanka’s blue chip companies – and why or why not?

A: It’s true that business confidence has deteriorated. So is this not the best time to invest in selected stocks when prices are low?

Organisations that are likely to witness higher share prices must be chosen cautiously. However, we must also not forget the net asset value of an organisation. All of this must be thoroughly studied – the herd instinct shouldn’t be followed.

Stockbrokers and many bankers assume that I have at least 15 research people working under me. The truth is that I make decisions on my own. If research professionals are good at what they do, they should be investing in the market.

At times, you must trust your intuition – and my intuition is always right.

All stock advisors hold daily discussions with research professionals, and stockbroking firms have their own research teams who advise them extensively. I listen to them at times; but I don’t always act on their advice.

Q: And finally, how do you stay informed about economic developments and the stock market?

A: I regularly review Central Bank statistics, listen to investor advisors and most of all, rely on my intuition.

Additionally, I analyse long-term stock trading patterns, consider company performance and valuations and stay updated by reading the newspapers to gain insights into current events. However, my decision-making process isn’t solely reliant on the indicators presented in newspapers.

My intuition is my strength.