Tamara Rebeira describes the nexus between FDIs and economic growth

Foreign direct investment (FDI) acts as a cornerstone of economic transformation; it has the potential to address investment imbalances, introduce advanced technologies, boost tax revenues and nurture human capital.

FDI also has the potential to expedite Sri Lanka’s climb to becoming an upper middle income country. In many developing countries, FDI has surpassed aid, remittances and portfolio investments to emerge as the primary source of external financing.

SIGNIFICANCE The optimistic goal is that over time, foreign investments will generate employment, elevate workforce pay levels and enhance productivity, leading to a more competitive economy.

FDI is also expected to assist the government in increasing tax revenues and creating leeway for lower levels of debt. This is particularly significant for Sri Lanka where borrowing rates have skyrocketed in recent times and debt has been all but unsustainable.

LEVERAGE According to the World Bank, Sri Lanka’s FDI has leveraged on mixed development projects, real estate, ports and telecommunications. And tourism is now at the top of the priority list in the government’s economic recovery plans, which also includes attracting export-oriented FDIs.

PLAYERS Here at home, state bodies such as the Central Bank of Sri Lanka, Colombo Stock Exchange (CSE), Sri Lanka Export Development Board (EDB), Insurance Regulatory Commission of Sri Lanka (IRCSL), National Chamber of Exporters (NCE) and Board of Investment (BOI) play indispensable roles in fostering FDI inflows, and laying the foundation for a more conducive economic landscape.

As the country’s financial decision maker, the Central Bank plays a crucial role in creating an enabling environment for FDI. Its policies influence inflation, and interest and exchange rates, which collectively impact investor confidence. By maintaining stable macroeconomic conditions, the monetary regulator creates an environment that attracts long-term inflows.

The BOI is the primary agency responsible for promoting and facilitating FDI. It offers incentives, streamlines approval processes and assists investors in navigating the regulatory landscape. The Board of Investment’s efforts directly influence FDI inflows and their impact on the national economy.

Meanwhile, a well-functioning stock market is an indicator of a country’s financial health. The CSE provides a platform for both domestic and foreign investors to participate in Sri Lanka’s economic growth story. By listing foreign companies and fostering a transparent trading environment, it enhances the visibility of Sri Lanka as an investment destination.

On the other hand, the EDB is tasked with promoting and facilitating exports and investment. It promotes exports by leveraging FDIs to boost domestic production capacity and tech adoption. Through strategic efforts, the EDB also supports the diversification of exports and attracts FDIs for industrial production.

In the realm of financial services, the IRCSL regulates the insurance sector to ensure stability and credibility. The regulator oversees and facilitates the insurance of FDIs by ensuring regulatory compliance, conducting investigations and maintaining vigilance.

Meanwhile, the NCE acts as a bridge between exporters and policy makers, and advocates for policies that support export growth. It facilitates joint ventures with foreign investors, addresses challenges faced by exporters, promotes diverse sectors and provides essential services, including training and market information dissemination.

STRATEGY Sri Lanka has recognised the need to attract FDI strategically; and in a bid to meet its goals, the government has implemented various policies and incentives. It goes without saying that the liberalisation of investment rules and regulations enables easier entry and operation by foreign companies.

TARGETS The BOI has set a target of attracting US$ 1.5 billion in FDIs this year and the first quarter saw the generation of 211 million dollars. Meanwhile, investments totalling US$ 682 million received BOI approval between January and July.

By understanding the relationship between FDI and economic growth, and implementing strategic policies to attract investments, Sri Lanka can unlock its potential as a thriving investment destination on a global scale.

“FDI also has the potential to expedite Sri Lanka’s climb to becoming an upper middle income country”

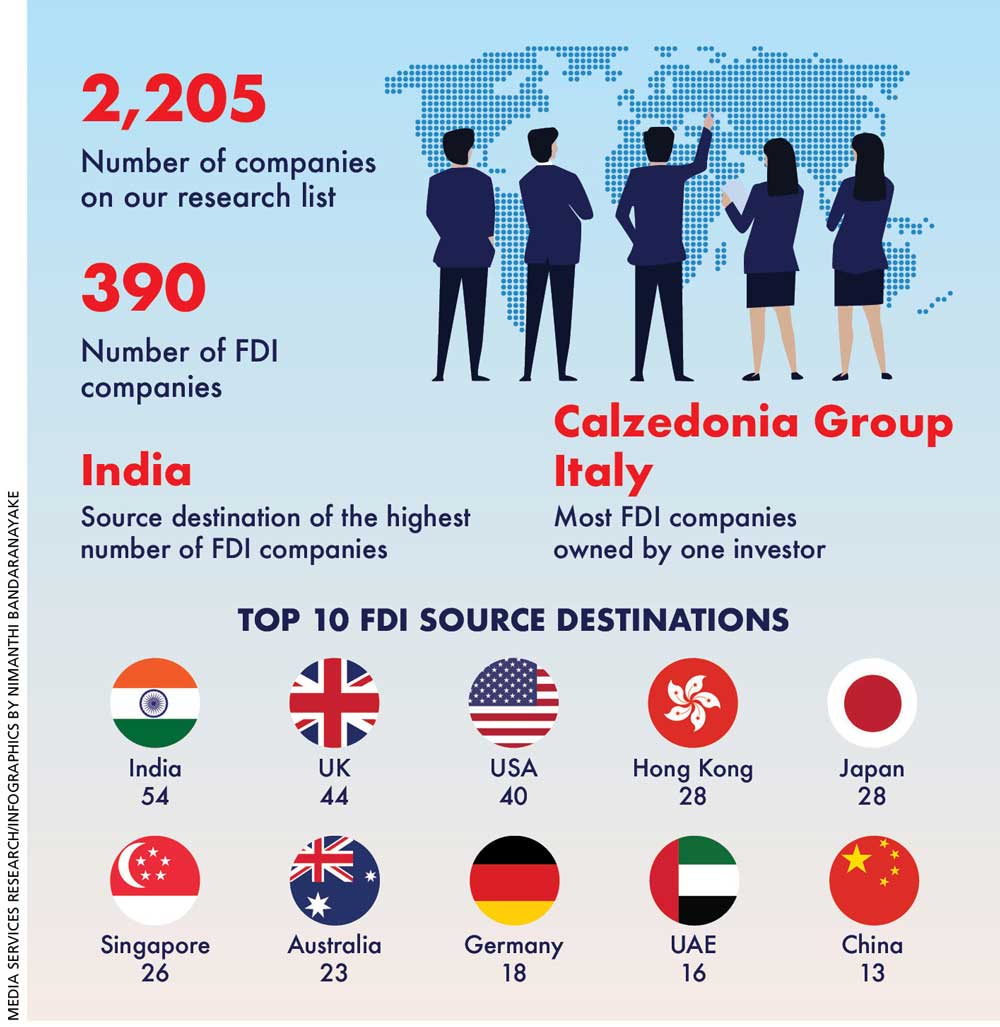

METHODOLOGY

Sri Lanka has faced an unprecedented economic crisis in recent times. It follows that the contribution of foreign direct investment (FDI) is vital for uplifting the economy and Sri Lanka’s financial woes.

The framework of this research is underscored by information published by several key institutions that play pivotal roles in the nation’s economic milieu.

They include the Board of Investment’s (BOI) in commercial and upcoming directories, Central Bank of Sri Lanka directory, Colombo Stock Exchange (CSE) directory, Insurance Regulatory Commission of Sri Lanka (IRCSL) directory, Export Development Board’s (EDB) premium exporters’ directory and National Chamber of Exporters (NCE) directory.

As economic growth is the main focus of this month’s cover feature, policies to attract FDI have been prioritised in developing strategies to promote growth and development.

The IMF’s definition (see FOOTNOTE) has been followed in identifying companies engaged in FDI activities. This definition is based on the fifth edition of the Balance of Payments Manual released back in 1993 by the International Monetary Fund.

It should be noted that there are limitations in conducting research of this magnitude due to the extent of information available on the internet – for example, company ownership and share portfolios.

In summary, this research is based on online sources with credible information being gathered from corporate websites, media releases and annual reports.

– LMD

FOOTNOTE

The term ‘FDI’ refers to an incorporated enterprise in which a foreign investor owns 10 percent or more of the ordinary shares or voting power in an incorporated enterprise, or an unincorporated enterprise in which the foreign investor has equivalent ownership.

Ownership of 10 percent of the ordinary shares or voting stock is the criterion for determining the existence of a direct investment relationship.

Entities that are deemed to be direct investors are as follows: subsidiaries (enterprises in which a non-resident investor owns more than 50%): associates (enterprises in which a non-resident investor owns between 10% and 50%); branches (unincorporated enterprises that are wholly or jointly owned by a non-resident investor) – all either directly or indirectly owned by the direct investor.

When the 10 percent ownership requirement for establishing a direct investment link with an enterprise is met, certain other enterprises that are related to the first enterprise are also regarded as direct investment enterprises. Therefore, the definition of direct investment enterprises extends to branches and subsidiaries of a direct investor and known as indirectly owned direct investment enterprises.

Working smart to attract FDIs

Dinesh Weerakkody

Chairman

Board of Investment of Sri Lanka

“As a country, we must work smarter to become more appealing to foreign investors”

Q: What initiatives is the Board of Investment (BOI) implementing to attract foreign direct investments (FDIs)?

A: There is great potential for investments in the areas of agriculture, tourism, information technology, renewable energy and education.

In addition, the government has committed to an array of important structural reforms to stabilise the crisis. These include enhancing revenue mobilisation, improving tax administration, cost recovery-based energy pricing, safeguarding financial sector stability and providing a stronger social safety net to protect the most vulnerable.

There are also reforms to enhance productivity and competitiveness, streamline the trade and investment environment, unlock growth potential, and address governance and corruption issues.

The BOI has established an Investor Facilitation Centre to streamline and fast track the approval process. It has also accelerated a promotional programme to attract 100 ICT companies and reinvestment in 50 existing BOI companies, established industry advisory councils for identified sectors and digitalised key investor service functions to improve the investment climate.

Modernising existing zones to meet international green standards, introducing a partnership finder database and launching a five year resident visa programme are a few other initiatives that have been implemented to attract investments.

The BOI is also working on other initiatives to facilitate investors – including formulating a robust system called Invest Sri Lanka to attract investments to compete with regional countries, provide a skilled workforce to meet the demands of investment projects and introduce an effective system for land allocation for such projects.

Q: Which sectors have shown potential for growth and investment opportunities?

A: In alignment with global trends that prioritise reinvestment over greenfield investments, the BOI has launched a proficient promotional strategy that’s aimed at drawing increased reinvestments.

This strategy calls for the implementation of an investor retention and expansion programme, and special incentives to promote reinvestment in existing BOI companies.

A comprehensive investment promotion campaign was recently introduced with the 100 ICT Companies programme to attract IT firms engaged in business process outsourcing (BPO), knowledge process outsourcing (KPO), business process management (BPM), data analytics and AI/machine learning (ML), and e-commerce.

In addition, manufacturing, services, agriculture, infrastructure and renewable energy have also been identified as promising areas for investment promotion, and selected based on Sri Lanka’s comparative and competitive advantages, existing market opportunities and the need to diversify the export sector.

Q: Are there any policy changes that the BOI is considering to create a more conducive environment for local and foreign investors? If so, what are they?

A: As a country, we must work smarter to become more appealing to foreign investors. To reform the business and investment climate, and raise national competitiveness, it is essential to establish a consistent policy environment that’s favourable for investment.

Inconsistent policies and ad hoc changes will severely impact investor confidence and hinder prospects of attracting foreign investments. An integrated investment law should also be in place to provide the basic legal framework required to facilitate the smooth functioning of investment plans.

Q: What’s your assessment of the new duty-free complex’s forex potential at the Port City Colombo?

A: Duty-free purchases at the Port City Colombo will be foreign currency (FCY) transactions and it’s envisaged that 70 percent of this revenue will be generated by tourists.

Based on the portfolio of products, the main consumer segments will be Indian, East Asian and European travellers looking to purchase premium duty-free products.

In contrast to the profit-based tax regime, the Colombo Port City Economic Commission has formulated duty-free commercial terms – i.e. a percentage-based share of the US Dollar top line revenue (of total sales).

During the initial five year rollout, total sales are estimated to exceed US$ 100 million, which will be generated based on projected tourist numbers. And a total forex revenue potential of 3.2 billion dollars is expected over the 20 year contract period.

Economic rebound on the cards

Dr. Nandalal Weerasinghe

Governor

Central Bank of Sri Lanka

“A sizeable and swift downward adjustment in market lending interest rates is expected in the near term”

Q: How do you assess the state of the economy at this time? And what are the key challenges the Central Bank of Sri Lanka is facing as we approach the end of yet another difficult year?

A: Sri Lanka is in the process of regaining macroeconomic stability by reining in inflation, building resilience in the external sector, and improving fiscal performance through fiscal consolidation and the debt restructuring process.

With the easing of monetary conditions and envisaged lessening of uncertainties in the post-debt restructuring period, the economy is expected to rebound while being underpinned by structural reforms and pro-growth policies.

The external sector is stabilising with the buildup of reserves and improved balance of payments position, which has strengthened the Sri Lankan Rupee this year.

Current global conditions and uncertainties could change the dynamics of key commodity prices, financial conditions, growth potential and financial flows – and have a bearing on inflation, economic growth and the exchange rate.

In addition, domestic supply disruptions due to weather conditions and economic slack could pose some challenges on multiple fronts.

The Central Bank will continue to monitor the effects of these developments on inflation and take appropriate measures.

Q: How is the Central Bank supporting economic growth?

A: The Central Bank’s mandate is price, economic and financial system stability.

Price stability is necessary for long-term economic growth and the monetary authority supports it by creating an enabling environment.

The Central Bank conducts monetary policy in line with the flexible inflation targeting (FIT) framework whereby it aims to stabilise inflation around the target, which is presently set at mid-single digit levels over the medium term, while minimising potential disturbances to the real economy.

The Central Bank also remains committed to ensuring stability of the financial system to safeguard the effective functioning of markets, and efficient financial intermediation to promote investment and growth.

Q: In view of recent amendments to the Central Bank of Sri Lanka Act, how is the monetary authority ensuring independence from external influences?

A: The Central Bank of Sri Lanka Act (CBA) identifies domestic price stability as the primary objective of the bank, and provides formal adoption of the FIT framework and enabling conditions to strengthen the independence of the regulator to pursue its policy formulation without external influence.

The CBA ensures greater accountability of the Central Bank to parliament and the public, with regard to its policies and outcomes.

And the governance structure has been changed to ensure that there’s no government representation in the monetary authority’s decision-making bodies – namely the Monetary Policy Board (MPB) and Governing Board (GB).

Fiscal dominance in monetary policy making has been avoided by restricting monetary financing of the fiscal deficit, except in national emergencies and a check on provisional advances to the government.

The removal of government representation in policy formulation and prohibition of monetary financing are expected to enhance the Central Bank’s operational independence.

Q: It’s widely believed that interest rates will continue to come down further in the near term. What is your response to this?

A: Market interest rates have begun reducing from the peak levels recorded last year. A further downward adjustment on rates for deposit and lending products is expected in the period ahead.

This is supported by the relaxed monetary policy stance, continued disinflation process, favourable inflation outlook – and well-anchored inflation expectations – improvements in domestic money market liquidity conditions and the reduction in the risk premia attached to government securities as uncertainty about domestic debt restructuring concerns has been largely cleared following the announcement of the domestic debt optimisation (DDO) strategy.

Accordingly, a sizeable and swift downward adjustment in market lending interest rates is expected in the near term; and they will remain lower than existing levels over the medium term.

FDI drives economic development

Dr. Kingsley Bernard

Chairman

Export Development Board

“FDI is vital for driving local export growth and economic development”

Q: What strategies are being implemented by the Export Development Board (EDB) to seize new opportunities in the global market?

A: Working closely with industry specific organisations, the EDB fosters collaboration to promote local products and services internationally.

By staying abreast of the latest market and industry trends worldwide, we educate suppliers and service providers on enhancing their competitiveness.

The EDB also conducts thorough market opportunity analysis in potential markets. These findings are shared with exporters to enable them to make informed decisions. We also encourage and facilitate exporters in conducting their own research to identify market opportunities.

Meanwhile, the EDB organises trade fair participation for exporters, and conducts B2B meetings and networking sessions to facilitate fruitful partnerships. Recognising the importance of innovation, we facilitate new product development with market requirements.

We place an emphasis on empowering SMEs, and encourage them to explore new markets and expand their presence in current markets through niche entries. By understanding various market access strategies, and packaging and labelling requirements, SMEs gain a competitive advantage.

Additionally, the EDB is committed to creating awareness among exporters about market information tools available online.

Q: How do foreign direct investments (FDIs) contribute to the export sector’s growth and expansion?

A: FDI is vital for driving local export growth and economic development. It contributes to increased exports by fostering domestic production capacity growth. FDI also brings new technology and innovative practices, and enhances the competitiveness of local industries by equipping businesses to better position themselves in global markets.

It is also instrumental in retaining domestic talent.

Given our stagnant export basket over the decades, FDIs present a significant opportunity to diversify and increase exports, particularly through industrial production and export led investments. The influx of foreign investments results in increased tax revenue and reduces the need for excessive borrowing.

Meanwhile, both FDIs and private investments from domestic sources contribute to economic growth and job creation.

Q: Are there any specific sectors that the EDB is actively focussing on to boost exports?

A: To enhance the export basket and capitalise on emerging potential areas, the EDB has targeted sections within the agriculture, industrial and service segments. As a result, the EDB is promoting the export of automotive parts; and it is also committed to nurturing the export capabilities of electrical and electronic product manufacturers.

Additionally, the EDB recognises the potential of the ICT and business process management (IT-BPM) sector. We endorse the export of software design and development services, AI solutions, fintech products and other IT services.

The Export Development Board also supports the increasing global demand for organic products and GI (Geographical Indication) certified goods. Marine and offshore services, wellness products and value added processed foods also contribute to the food processing sector’s growth.

Q: What role can the EDB play in enhancing Sri Lanka’s image to attract business opportunities in the world market?

A: The EDB has adopted a range of strategic interventions and initiatives to enhance trade performance by showcasing local trade, industries and services on global platforms.

With a strong focus on brand building and positioning, the EDB upholds Sri Lanka both globally and locally by underscoring its strengths in various products and services.

To capitalise on business opportunities in international markets, the EDB works with Sri Lankan missions overseas, identifying and attracting potential partnerships. Targeted trade fair participation is a key aspect of our approach as we aim to attract new buyers and establish connections through B2B meetings.

In addition, the Export Development Board collaborates with multiple public, private, diplomatic and global partners to promote Sri Lankan trade using conventional and digital channels.

And recognising the significance of SMEs in the export landscape, we facilitate their participation in global trade events and exhibitions, and empower mid-range exporters to thrive.

Work in progress on the FDI front

Shiham Marikar

Secretary General/CEO

National Chamber of Exporters

“Joint ventures are a means of bridging capital deficits – so Sri Lanka should promote its resource rich sectors”

Q: What’s your take on Sri Lanka’s foreign direct investment (FDI) prospects?

A: Sri Lanka has great potential to attract FDI. However, there are key factors that must be considered and prospects for FDI will remain low until our credit rating improves.

It’s important that political stability and our ranking in the Ease of Doing Business Index improve.

Sector wise, regulatory barriers, corruption, procedural obstacles and increasing costs also impede FDI inflows. Certain authorities that promote FDI have been unsuccessful – despite having a large workforce – in attracting investments compared to countries such as Bangladesh and Vietnam.

Foreign investors are unlikely to enter when a suitable business environment doesn’t prevail. Sri Lanka’s current FDI to GDP ratio is around two percent – an increase of only one percent over the past 10 years.

Meanwhile, investment growth will be slow with ongoing crises including international debt servicing defaults and delays, the IMF bailout, import restrictions and controls, and poor forex inflows to date.

However, India, China, the US and some EU countries have shown an interest in investing in mineral mining in Sri Lanka.

Q: Should our exporters work towards seeking joint venture opportunities with prospective foreign investors?

A: Yes, they should do so as it will increase capacity, share risks, and open access to new knowledge and expertise. These joint ventures are very beneficial to local exporters especially during challenging times.

In Sri Lanka, joint ventures are eligible for the same preferences and tax benefits as domestic companies. There are no restrictions on foreign ownership, except in certain specified sectors. Local exporters should consider joint ventures with online sales companies that are becoming increasingly popular. Having a distribution office will facilitate this operation.

Joint ventures are a means of bridging capital deficits – so Sri Lanka should promote its resource rich sectors such as minerals, agriculture and renewable energy – including solar, wind, hydropower and biomass resources.

Q: What are the key challenges faced by foreign investors lookingto engage in export activities? Andhow is the National Chamber of Exporters (NCE) supporting them?

A: The NCE works closely with foreign agencies to attract international companies to partner with our exporters, increase capacity and encourage joint ventures.

We’re in regular contact with Sri Lankan missions and trade chambers overseas to conduct image building programmes that highlight Sri Lanka as an export hub.

Furthermore, the NCE is also inviting international businesses to collaborate and partner with our exporters. The challenges include import controls and restrictions, our low ranking in the Ease of Doing Business Index, corruption, and absenteeism and lethargy in the public sector.

Q: Which sectors is the NCE focussing on to bolster Sri Lanka’s export earnings?

A: We promote all sectors. Based on recent chamber activities and member interest, the focus has been on the food and beverage sector including tea and spices.

Special programmes are also carried out to promote ICT, rubber and industrial products and services. We are also focussed on agriculture, horticulture, coconut kernel products, coir fibre and rubber products.

Q: How does the NCE support and promote the interests of exporters?

A: The National Chamber of Exporters provides many services that are beneficial to local exporters. We highlight the issues they face to relevant state institutions and at forums with a view to resolve them.

Moreover, the chamber organises monthly sectoral meetings for members under the leadership of sectoral heads in the council to strategically plan for those sectors, and highlight policy and operational issues that need resolution.

We also disseminate trade inquiries and leads received from overseas trade chambers and other partners.

The NCE conducts training and workshops on related subjects, and shares market information and trade statistics. In coordination with regional chambers, we run a programme to link producers with member exporters. And we recognise and reward exporters at the NCE’s Annual Export Awards.

Bullish about a sustainable turnaround

Dilshan Wirasekara

Chairman

Colombo Stock Exchange

“The next five years will be a period of renaissance for the country that we haven’t witnessed since independence”

Q: How important are foreign investments in the context of the Colombo Stock Exchange (CSE)? And likewise, why is the CSE a viable platform to pursue foreign investment inflows, in your assessment?

A: They are critical – not just from a CSE perspective but a country’s perspective as well. As a nation, we have faced concerns as some foreign exchange inflows over the past years have been debt related, and entail an interest cost and repayment. These inflows can be short term – so as soon as macro fundamentals become unstable, they flow out.

In terms of capital flows of foreign investors, they take a long-term view. And they don’t affect debt dynamics – including the debt to GDP ratio or debt servicing obligations. We must convert and move away from debt to non-debt related investments.

The CSE is a good platform to promote listed companies and listed debt. Following continuous outflows for four years since 2017, we recorded a net foreign inflow last year both from a secondary and primary market point of view.

Collectively therefore, we received Rs. 50 billion in net foreign inflows from these markets, which is one of the highest we’ve seen historically. And so far this year, net foreign inflows have been positive at around five to six billion rupees.

Q: How does the CSE encourage foreign investors to participate in the stock market? And how has the exchange performed in recent years in the context of foreign investor activity or turnover?

A: We engage with them on multiple fronts – the main component being the planning of road shows. We travel to foreign markets and financial hubs such as Singapore, Tokyo, Australia and the Middle East to attract investments.

We’re also planning a forum in the first quarter of next year to cover London, New York and Toronto.

At these road shows, we showcase ‘Invest Sri Lanka’ forums, and facilitate listed companies to enter the stock exchange.

The second mechanism is where we engage with foreign media such as Bloomberg and Reuters for visibility to promote the CSE and Sri Lanka’s capital markets.

The third is where the CSE encourages market intermediaries who tie up with other broking establishments to canvass business through chaperoning arrangements.

Over the past three years, due to the financial crisis, foreign investor activity reduced from 35 percent of turnover to five percent last year. However, we’re seeing it gradually moving closer to the 10 percent mark this year.

On another note, there are concerns among foreign investors due to the conversion of capital back to foreign currencies when investors move out. We faced some delays last year and that may have led to negativity. However, the CSE lobbied the regulator and cleared the backlog.

The next is the liquidity factor: here again, some foreign investors say our market liquidity, free floats and traded volumes are insufficient to warrant the larger funds to come in. This is something we’re addressing as well.

Product diversification to attract foreign investors is another mechanism. Unfortunately, we’ve been a dual product market for a long time – we simply have plain vanilla equity and listed debt. We’re addressing this by introducing new products.

Q: According to the LMD-NielsenIQ Business Confidence Index (BCI), confidence in business circles continues to fluctuate against the backdrop of economic volatility. How does the CSE navigate such uncertainties?

A: It’s important to maintain a positive outlook. Volatility in confidence levels can translate into market volatility; and for the CSE, volatility in markets presents an opportunity for investors. There’s no opportunity to make money if the markets remain static.

I believe that sentiment will improve moving forward as Sri Lanka has achieved the quickest turnaround from an economic crisis in the world. And we have showcased ourselves as one of the most vibrant democracies.

As for progression, there are uncertainties – including foreign debt restructuring, the conduct of elections and policy consistencies.

Today, it’s everyone’s responsibility to ensure that we stay the course of a reformed path. The next five years will be a period of renaissance for the country that we haven’t witnessed since independence.

So the CSE remains bullish.

Foreign investors may open branches

Razik Zarook

Chairman

Insurance Regulatory Commission of Sri Lanka

“There is an interest among insurance companies in establishing branches within the Port City Colombo”

Q: What is the regulatory framework governing foreign direct investments (FDIs) in the insurance sector – and how has it evolved?

A: The insurance sector, which was initially overseen by the Controller of Insurance, has evolved over time. In 2000, the establishment of the Insurance Board of Sri Lanka (IBSL) marked a significant development; and subsequently in 2017, it was transformed into the Insurance Regulatory Commission of Sri Lanka (IRCSL).

With one insurance company at the inception, the landscape today boasts 28 organisations, primarily categorised as life and general insurance. The mandate of the IRCSL is to safeguard the interests of policyholders.

In the context of FDI, the country’s legal framework is applicable to all entities. International insurance companies operate locally, and there are no restrictions concerning foreign investments in the insurance domain.

When setting up, foreign entities are required to incorporate a Sri Lankan company for their insurance operations. However, these organisations are subject to the IRCSL’s regulatory purview. The ownership structure can also entail full foreign ownership.

Q: Are there specific procedures that foreign investors must follow in Sri Lanka vis-à-vis the domestic insurance sector?

A: Investment flows into the country through the primary avenue of banking systems. It’s important that we have a comprehensive understanding of incoming entities.

Similar to the principles outlined in the Know Your Customer (KYC) policy, it is also the responsibility of banks to be aware of the entities investing here.

IRCSL conducts its own investigations, and assesses an organisation’s authenticity, history, and financial resources and soundness. If there’s anything suspicious following the evaluation, the matter comes under the Financial Intelligence Unit’s (FIU) purview.

Subject to these guidelines, no other limitations are imposed.

Q: How does the IRCSL support and encourage FDI in the insurance sector?

A: We are fully committed to facilitating FDI and there are no limitations in this regard.

However, no distinctive privileges or advantages are extended to investors. These entities fall within the IRCSL’s oversight and purview; they must adhere to stipulated rules, regulations and directives – and they will be governed by the laws of the land.

Q: What support or incentives, if any, does the IRCSL provide to foreign insurers in the domestic market?

A: Equal treatment is a fundamental principle that the IRCSL upholds and no preferential treatment is extended to foreign insurers. FDI is considered to be on a par with all other incorporated entities. Our commitment to supporting them however, remains unwavering.

Pertaining to listing requirements, certain exemptions have been granted. If a parent company is enlisted on a recognised stock exchange, the subsidiary is not required to be listed in Sri Lanka.

Q: In your view, will the Port City Colombo’s expansion have a significant impact on the insurance sector?

A: Yes, we support and promote expansion. There is an interest among insurance companies in establishing branches within the Port City Colombo. These endeavours fall within the oversight of the IRCSL and nothing is hindering them from opening branches within the Port City Colombo.

Q: And how does the IRCSL address challenges related to FDI in the insurance sector?

A: There are minimal challenges associated with FDI. IRCSL maintains an open and constructive dialogue approach, and examines each incident on a case-by-case basis to address any concerns that may arise.

Our outlook is one of positivity in handling all matters. With the appropriate FIU clearance and a commitment to transparency in investments, potential challenges can be averted.

Any concerns are promptly directed to the FIU for thorough assessment. Prior to the commission, banks conducted comprehensive evaluations of FDIs. Given the substantial capital inflows, both the banks and FIU maintain a vigilant stance.

IRCSL proceeds once bona fide confirmation is obtained. However, in the event of any suspicions or clarifications required, matters are referred to the FIU for scrutiny. Our evaluation also involves an examination of the ultimate beneficial donor’s identity.